Several of the UN’s sustainable development goals will not be possible to achieve given the current rate of progress. As a development finance institution, it is imperative that we innovate and find ways of generating more positive effects from our work more quickly, and that we measure these effects.

Renewed and deepened impact work

This last year, we have worked on the renewal of our impact work to support the natural integration of impact on society in the investment process, in the same way that ESG has previously been integrated. The ambition is that we will always explore the possibilities of lifting an investment beyond regulatory compliance, in order to create added value.

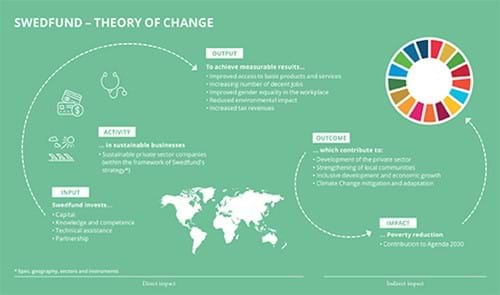

We have laid the foundations for systematic impact work. As an initial step, we developed a Theory of Change for Swedfund (see the illustration, click for enlargement). This is about understanding and identifying the effects that we can create through our investments, as well as developing the ability to measure them in a credible way.

Swedfund’s direct impacts can be measured by collecting data and compiling various key figures. The indirect impact is more difficult to demonstrate through data, and we have therefore initiated impact studies in order to clarify different effects and relationships.

IFC Impact Principles, EDFI and 2x

Swedfund's working methods are also being developed through our decision to sign up to IFC's Operating Principles on Impact Management. These give us a set of principles concerning how impact should be integrated into the operation. (www.impactprinciples.org.)

We have also been active in the work to increase the degree of harmonisation within EDFI, where the principles of responsible investment have now been updated to include impact.

During 2019, we have further stepped up our efforts to ensure that our investments have a positive impact as regards gender equality and climate. We are particularly proud to have taken on the 2x Challenge, a G7 initiative aimed at increasing investment in women's development, in women-led companies, and in companies that employ many women or offer products and services for women. The goal is for 60% of the companies in our portfolio to fulfill the 2x criteria. Alongside this, we are continuing to develop our own tools to help companies become more equal; Women4Growth being one example.

New mission goal for the climate

We have developed our own work relating to the issue of climate. Using the Paris Agreement as a starting point, we have now established a new mission goal which requires us to have a climate-neutral portfolio by 2045, i.e. the same year in which Sweden as a country is to be climate-neutral. This means that our portfolio will capture the same amount of carbon dioxide as the holdings in our portfolio emit into the atmosphere. Greenhouse gas emissions from our portfolio per invested krona will also decrease.

To develop relevant measurement methods and secondary goals we are working as part of a test group for the Science Based Targets initiative, and have joined TCFD, a framework for the reporting of climate risks by investors.

You find more information on our work in our Integrated Report 2019.