Our portfolio

We always aim to establish a good balance between risktaking, geographical spread and variation in investment instruments, such as equity, funds and loans.

We invest directly in companies and indirect through financial institutions and funds, to increase the proportion of small and medium-sized enterprises and to promote entrepreneurship.

The portfolio's total contracted amount at the close of 2021 was > 8,4 billion SEK, divided between 64 investments.

Portfolio per region 2022

Africa 65%

Asia 30%

Eastern Europe 5%

Latin America 0%

Other* 0%

Portfolio per sector 2022

Financial inclusion 59%

Energy & Climate 33%

Health 6%

Other 2%

Portfolio per instrument 2022

Funds (equity) 51%

Funds (debt) 8%

Loans 31%

Equity 10%

* In 2022, the ‘Other’ category, which historically included investments with a broad geographical mandate, was distributed to underlying countries based on actual distribution and qualified pipeline.

Our portfolio companies

-

Search among our portfolio companies

You can use the search word of your choice (such as business, sector or form of investment) or year to filter the list of portfolio companies.

Examples of investments and financial support

Since 1979 we have invested in more than 230 companies in the poorest countries in the world. Here are some recent examples.

-

Developer of small-scale water, solar and wind energy

-

Microfinance – research shows a two-sided tool

-

Swedfund's investment in the 1990s facilitated mobile telephony in Namibia

-

Investment in a medical clinic in Liberia which has survived both war and Ebola

-

Lending to small and medium sized enterprises in East Africa creates more jobs

-

Zimbabwe's banking sector is strengthened

Our Arena

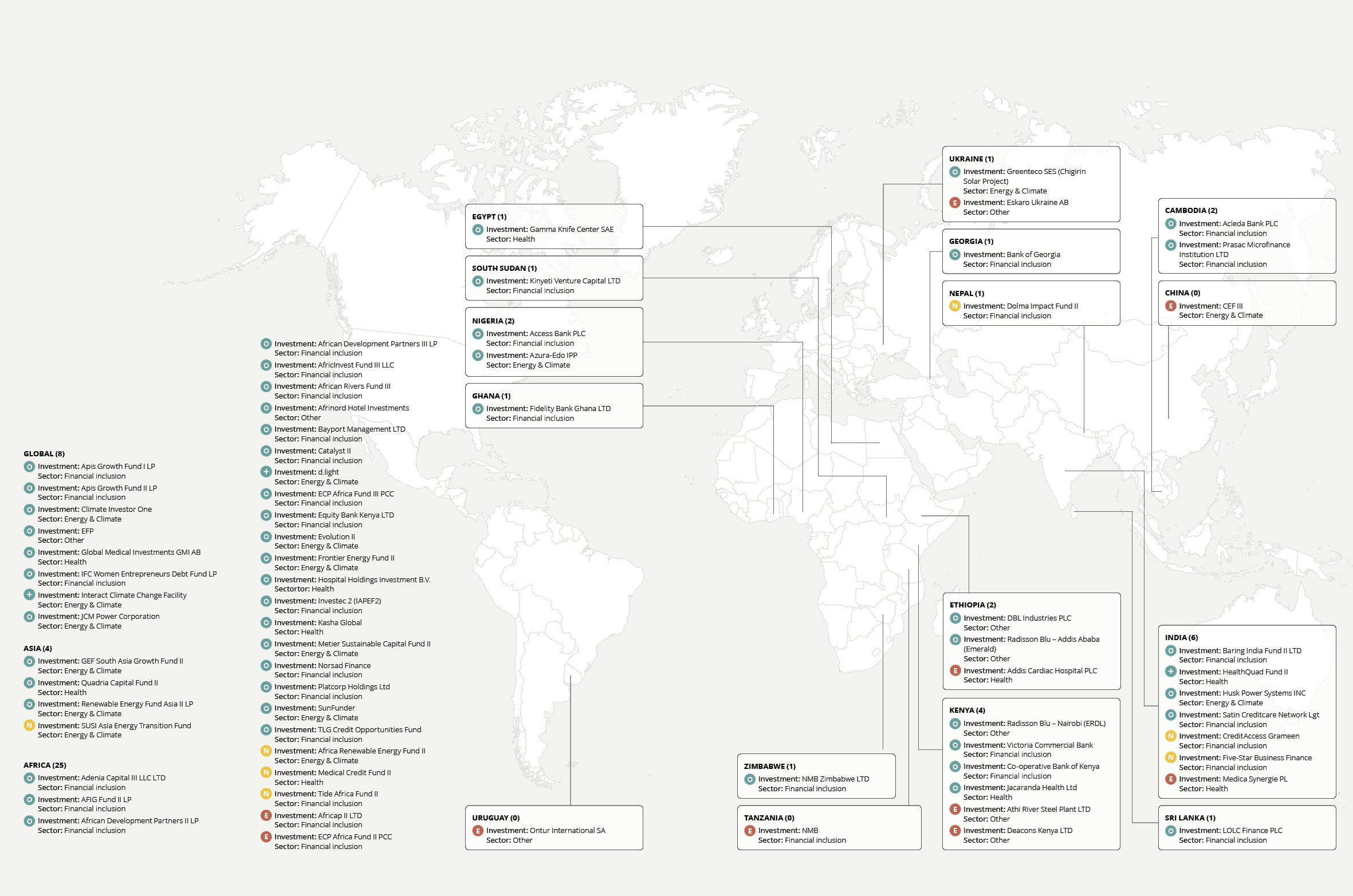

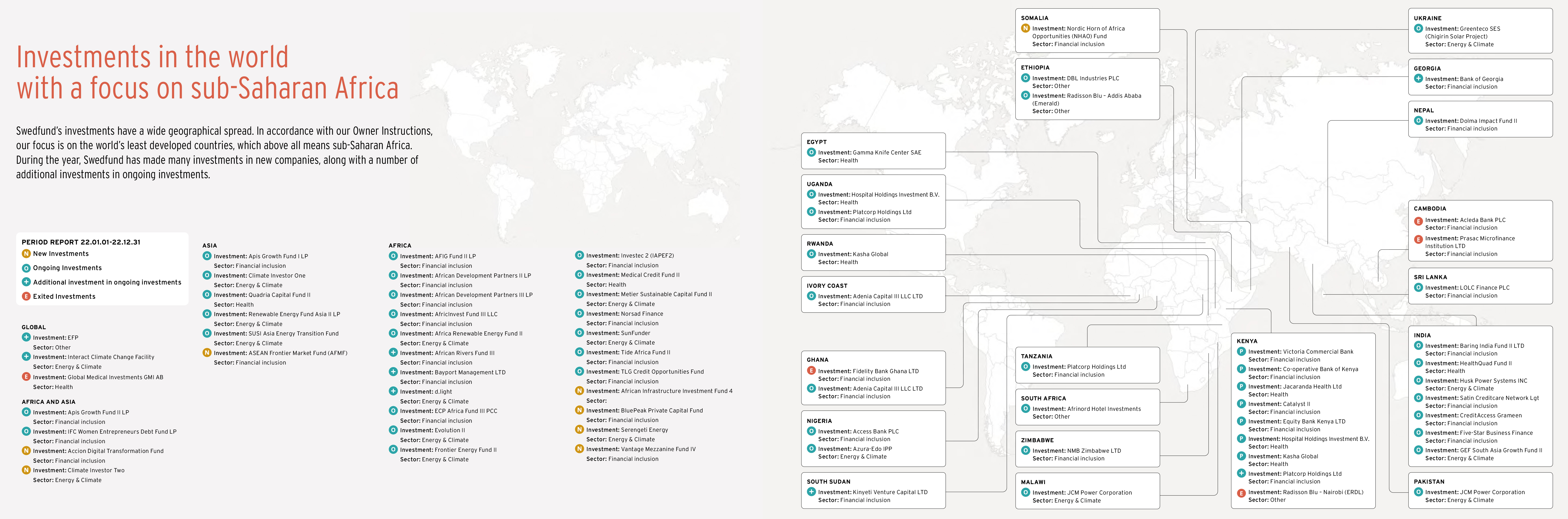

Swedfund's investments have a wide geographical spread. Our focus in on the world's least developed countries, which primarily means sub-Saharan Africa. We also invest in low- and middle-income countries and post-conflict countries - and in exceptional cases in upper-middle-income countries.

This map shows Swedfund's investments at the end of 2022. (click for a larger version)